Posted on May 16, 2016 by steveblank

We just held our seventh week of the Hacking for Defense class. Now with over 750 interviews of beneficiaries (users, program managers, stakeholders, etc.) almost all the teams are beginning to pivot from their original understanding of their sponsor’s problem and their hypotheses about how to solve them. Minimal viable products are being demo’d to sponsors and sponsors are reacting to what the teams are learning. This week teams figured out how to measure mission achievement and success, and our advanced lectures were on activities, resources and partners.

(This post is a continuation of the series. See all the H4D posts here. Because of the embedded presentations this post is best viewed on the website.)

—-

Why Innovation in Government Is Hard

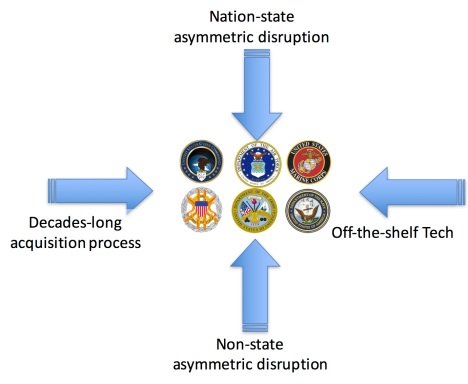

As we spend more time with the military services, commands and agencies it’s apparent that getting disruptive innovation implemented in the DOD/IC face the same barriers as large corporations (and a few more uniquely theirs.)

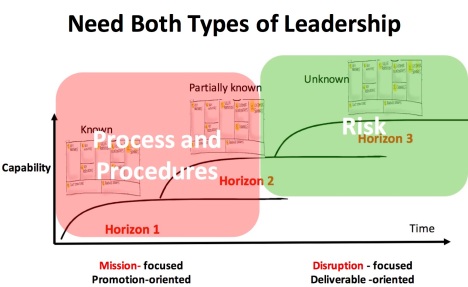

The first barrier to innovation is the Horizon 1 leadership conundrum. In corporations, the CEO and executives have risen through the ranks for their skill on executing existing programs/missions. The same is true in most DOD/IC organizations: leadership has been promoted through the ranks for their ability to execute existing programs/missions. By the time they reach the top, they are excellent managers of processes and procedures needed to deliver a consistent and repeatable execution of the current core mission (and typically excellent political players as well.)

These horizon 1 leaders are exactly who you want in place when the status quo prevails – and when competitors / adversaries react as per our playbook.

To these Horizon 1 leader’s, innovation is often considered an extension of what they already do today. In companies this would be product line extensions, more efficient supply chain, new distribution channels. In the DOD/IC innovation is often more technology, more planes, more aircraft carriers, more satellites, etc.

This “more and better” approach works until they meet adversaries – state and non-state – who don’t follow our game plan – adversaries who use asymmetry to offset and degrade our technological or numerical advantages – roadside bombs, cyberattacks, hybrid warfare, anti-access/area denial (A2/AD), etc.

History tells us that what gets you promoted in peacetime

causes you to lose in wartime.

When Horizon 1 leaders set up innovation groups the innovators at the bottom of the organization start cheering. Meanwhile the middle of the organization strangles every innovation initiative. Why? Most often four points of failure occur:

- Horizon 1 leaders tend to appoint people who they feel comfortable with – Horizon 1 or perhaps Horizon 2 managers. This results not in innovation, but in Innovation Theater – lots of coffee cups, press releases, incubators and false hopes, but no real disruptive changes. Horizon 3 organizations require Horizon 3 leadership (with Horizon 1 second in command.)

- There needs to be effective communication about what being innovative means to different parts of their organizations as well as defining (and enforcing) their expectations for middle management. How do middle mangers know how to make trade-offs between the efficiency requirements of their Horizon 1 activities and the risks required of a Horizon 3 activity?

- They have to create incentives for middle management leaders to take on horizon three ideas

- They have to change the metrics across the entire organization. If not, then the effectiveness of the Horizon 3 effort will be graded using Horizon 1 metrics

Secretary of Defense Carter’s recent pivot to place the DOD’s innovation outpost – DIUx directly under his supervision after 8 months is a great example of a leader enforcing his expectations about innovation.

In peacetime Horizon 3/disruptive groups need to be led by Mavericks, sponsored and protected by Horizon 1 leadership. It is this group, challenging the dogma of the existing programs, who will come up with the disruptive/asymmetric offset technologies and strategies.

BTW, history tells us that in war time the winners filled this innovation role with people who make most Horizon 1 leaders very uncomfortable – Churchill in WWII, Billy Mitchell, Oppenheimer on the Manhattan Project, Vannevar Bush at the OSRD, John Boyd, etc.

More next week on innovation and the intransigent middle. Now back to the class.

Team Presentations: Week 7

In a company you know you’ve been successful when you generate revenue and profit. But in the military success has different metrics. This week the teams’ assignment was to understand what Mission Achievement and/or Mission Success looked like for each of their sponsor organizations and each of the beneficiaries inside that organization.

Later in the class some of the team will realize they can build “dual-use” products (building their product primarily for civilian use but also sold to the military.) In those case revenue will become an additional metric.

Understanding how to measure mission achievement/success for each beneficiary is the difference between a demo and a deployed solution.

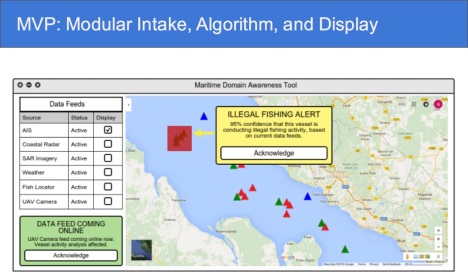

Sentinel initially started by trying to use low-cost sensors to monitor surface ships for their 7th fleet sponsor in a A2/AD environment. The team pivoted and has found that their mission value is really to enable rapid, well-informed decisions by establishing a common maritime picture from heterogeneous data.

On Slide 4-5 the team continues testing their hypotheses via customer discovery. Note that they plan a trip to San Diego to visit the customer. And they realized that an unclassified proxy for their data is the IUU fishing problem. (With a great assist from the State Departments innovation outpost in Silicon Valley.) Their Minimum Viable Product can be seen on slides 12-16 using this illegal fishing data.

On Slide 4-5 the team continues testing their hypotheses via customer discovery. Note that they plan a trip to San Diego to visit the customer. And they realized that an unclassified proxy for their data is the IUU fishing problem. (With a great assist from the State Departments innovation outpost in Silicon Valley.) Their Minimum Viable Product can be seen on slides 12-16 using this illegal fishing data.

Slide 10 summarized what mission achievement would look like for three beneficiaries in the 7th fleet.

If you can’t see the presentation click here

Capella Space started class believing that launching a constellation of synthetic aperture radar (SAR) satellites into space to provide real-time radar imaging was their business. Now they’ve realized that the SAR data and analytics is the business. Then the question was, “For whom?”

In slides 4- 11 they describe what they learned about illegal fishing in Indonesia (Thanks again to the State Departments innovation outpost.) But the big idea on slide 12 – 13 is that Capella has pivoted. The team realized that there are many countries that want to detect boats at night. And most of the countries of interest are located in the equatorial belt. Slide 14 is their rough outline of mission achievement for the key agencies/countries.

Interesting to note that Capella Space and Team Sentinel seem to be converging on the same problem space!

If you can’t see the presentation click here

NarrativeMind is developing tools that will optimize discovery and investigation of adversary communication trends on social media, allowing the U.S. Army Cyber Command (ARCYBER) and others to efficiently respond and mitigate threats posed by enemy messaging.

In slide 4 the team provided a textbook definition of mission achievement. They specified what success looks like for each of the beneficiaries inside of their sponsor, ARCYBER. In slide 5 they broadly outlined mission achievement for three private sector markets.

In slides 6-9 they plotted all the potential adversary communication trends on social media problems, and in slide 7 overlaid that problem space with existing commercial solutions. Slides 8 and 9 show the problems not yet solved by anyone, and slide 9 further refines the specific problems this team will solve.

NarrativeMind further refined their Minimal Viable Product to product/market fit in Slides 11-16.

If you can’t see the presentation click here

Aqualink started the class working to give Navy divers in the Naval Special Warfare Group a system of wearable devices that records data critical to diver health and safety and makes the data actionable through real-time alerts and post-dive analytics. A few weeks ago they pivoted, realizing that the high-value problem the divers want solved is underwater 3-D geolocation.

Slide 2, John Boyd and the OODA Loop (finally!) makes an appearance in the class. (The OODA loops and the four steps of Customer Development and the Lean Methodology are rooted in the same “get of the building/get eyes out of your cockpit” and “speed and urgency” concepts.) In Slides 5-7 Aqualink’s two versions of their Minimum Viable Product are beginning to be outlined and in Slide 8, the team passed around physical mockups of the buoy.

If you can’t see the presentation click here

Guardian is trying to counter asymmetric threats from commercial drones for the Army’s Asymmetric Warfare Group.

The team certainly got out of the building this week. In between their classes they flew to the east coast and attended the Army’s Asymmetric Warfare Drone Demo-Day at Fort A.P. Hill in Virginia. They spoke to lots of vendors and got a deep understanding of currently deployed tactical drones.

Slides 5-9 show their substantial progress in their Minimal Viable Product as they demo’d advanced detection and classification capabilities. They are beginning to consider whether they should pivot to become a drone software platform.

If you can’t see the presentation click here

Right of Boom is trying to help foreign military explosive ordnance disposal (EOD) teams better accomplish their mission. Now they are developing systems, workflows, and incentives for allied foreign militaries with the goal of improved intelligence fidelity.

This week the team was actually able to talk to a key beneficiary on the front lines overseas. What they discovered is that the JIDA current technical solutions, if combined, will provide a solution of equal quality to standalone development in a shorter timeframe.

On slide 4 they outlined their Mission Achievement / Success criteria for the key JIDA beneficiaries. Slide 9 continued to refine their understanding of the tradespace.

If you can’t see the presentation click here

Skynet is using drones to provide ground troops with situational awareness – helping prevent battlefield fatalities by pinpointing friendly and enemy positions.

Mission achievement on slide 2 needs a bit of explanation; the team has met and exceeded their basic goals to reach: 80% accuracy on target identification. From SOCOM’s perspective the team has achieved their initial mission. Now Skynet has moved beyond their original scope into an interesting area. Slide 9 and 10 show their further refinement of buy in- for SOCOM and the Border Patrol.

If you can’t see the presentation click here

Advanced Lecture – Activities, Resources and Partners

Pete Newell presented the advanced lecture on Activities, Resources and Partners.

Activities are the expertise and resources that the company needs to deliver the value proposition. Resources are the internal company-owned activities. Examples are a company-owned manufacturing facility, big data or machine learning engineers, DOD proposal writers, venture capital, etc. Partners are the external resources necessary to execute the Activities. i.e. outsourced manufacturing, system integrators, etc.

If you can’t see the presentation click here

Lessons Learned

- History tells us that what gets you promoted in peacetime causes you to lose in wartime

- Teams are making substantive pivots on their understanding of the real sponsor problem and pivoting on their proposed solution

- Understanding how to measure mission achievement/success for each beneficiary is the difference between a demo and a deployed solution